Why this matters

We grew up watching our neighbors navigate systems that weren’t built for them—long lines, high fees, and endless manual processes. Today, despite all the innovation, Latinos are still locked out of financial opportunity:

10.2 million

Every week, over 10.2 million people send money to LATAM.

60%

Still use cash, leading to higher costs, longer waits, and less security.

6 million

Latino workers remain unbanked, keeping employers and employees tied to costly, outdated systems.

Behind every number is a family working hard, waiting longer, and paying more than they should.

The problem

Money should not be this hard

Latino field & service businesses and workers face outdated, manual, and costly systems that weren’t designed for them.

The challenges may look different at each level, but they’re connected—and the result is the same: financial growth is blocked for everyone.

- Language barriers

- Manual work, costly mistakes

- Chasing hours takes time

- Paydays are a headache

- Hard to get paid

- Costly to send money home

- Long check cashing lines

- Hidden, high fees

How financial stress impacts productivity:

For every 100 employees, you're losing 168+ productive hours weekly or 4.2 full time employees.

The solution

Financial Access Starts at Payday

We realized what others failed to see: payday is the root of financial access. By making it easier for employers, we unlock better financial opportunities for workers and their families.

From hours worked to money sent home, miPlata connects every step, making it affordable, simple, fast, and safe for everyone.

The approach

How we make plata simple

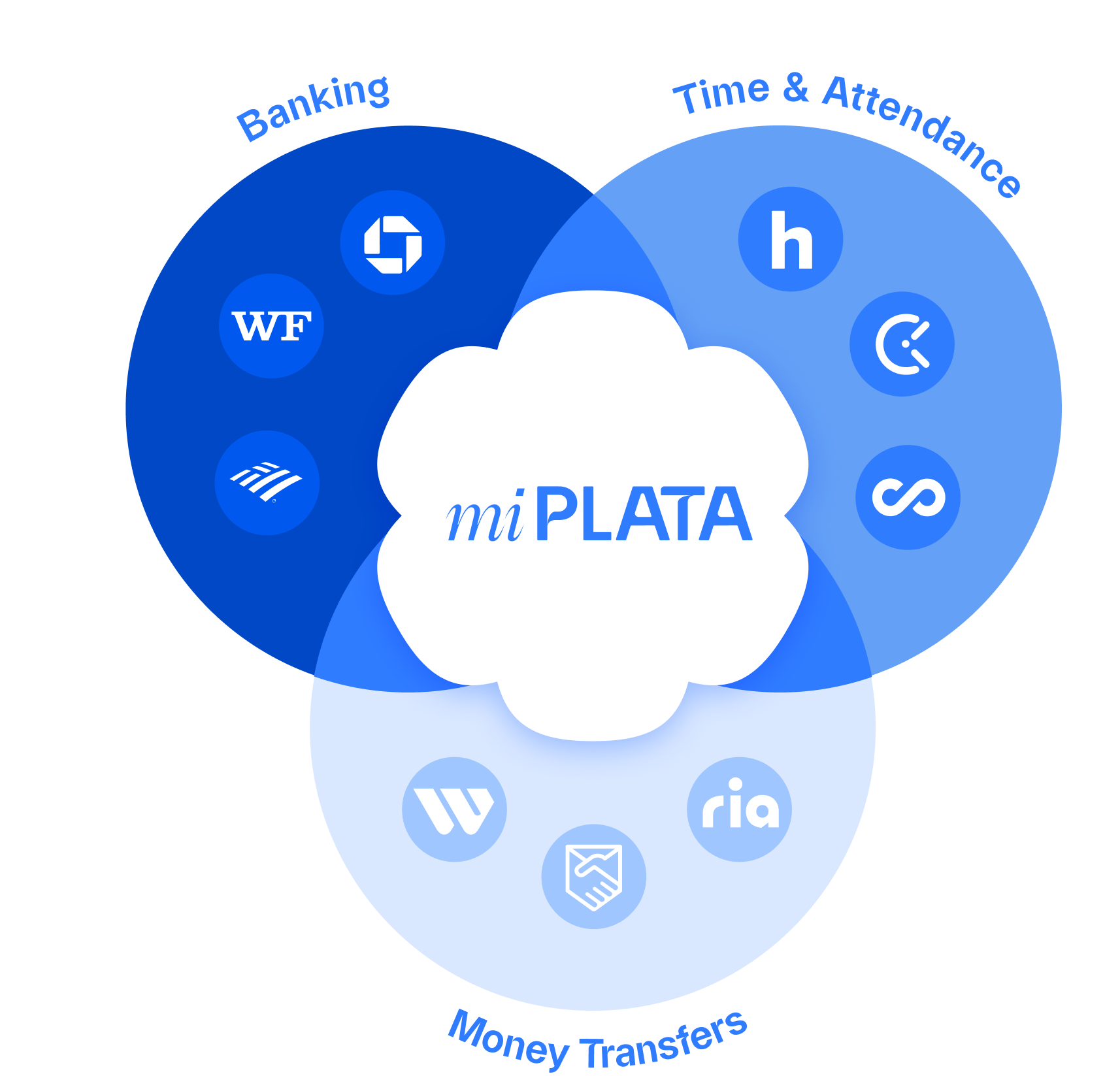

Money in our community moves through too many disconnected steps—timekeeping, payroll, banking, and remittance. Each adds cost and confusion.

miPlata brings them all together. No setup, no juggling accounts, no separate transfer service. Money flows simply, all in one place.

Savings with miPlata:

Interested?

Get in touch.

- WhatsApp: +1 (855) 635 2022

- ayuda@conplata.com